Application Description

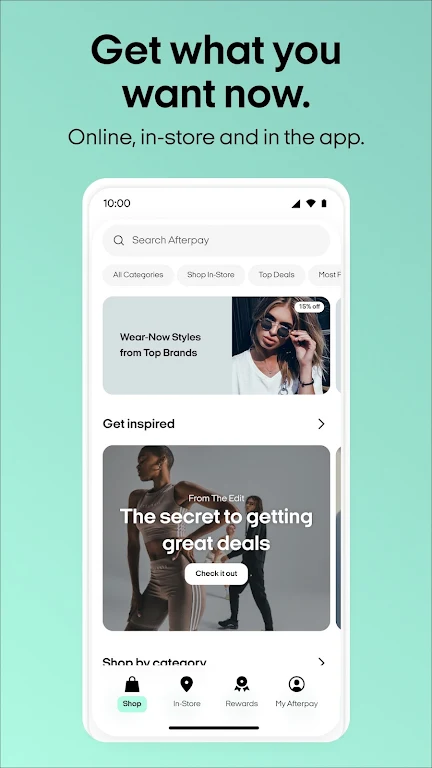

Afterpay: Buy Now, Pay Later is a fintech app offering a flexible payment solution for online and in-store purchases. Enjoy convenient installment payments with no interest or fees, giving you the freedom to buy now and pay later. Partnering with numerous retailers, Afterpay provides access to a wide array of products and services. Its user-friendly interface and seamless checkout experience redefine the shopping and payment process.

Features of Afterpay: Buy Now, Pay Later:

- Exclusive App Benefits: Access app-only deals, discounts, and a broader selection of brands and products.

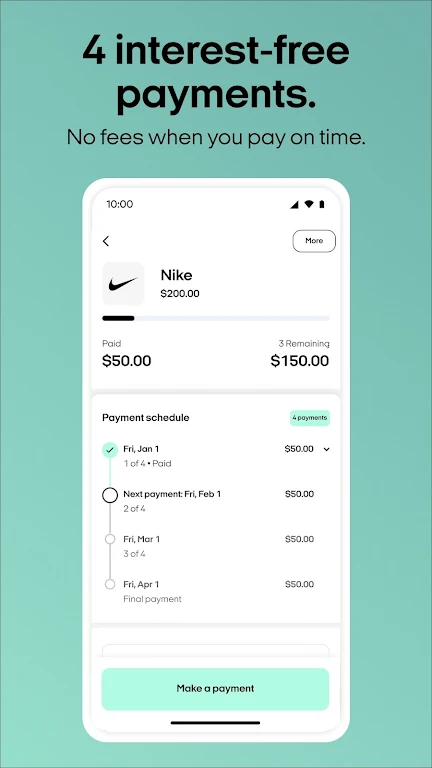

- Interest-Free Installments: Split purchases into four interest-free payments for easier budget management.

- Extended Payment Options: Choose to pay in 6 or 12 months for larger purchases (where available).

- App-Exclusive Brands: Discover unique brands and products available only through the Afterpay app.

Frequently Asked Questions:

Can I use Afterpay in stores? Yes, Afterpay is accepted at many in-store retailers.

How do I manage my payment schedule? Easily manage payments, pause for returns, and review your order history within the app.

How do I receive sale alerts? Enable push notifications for sale alerts and price drops on your favorite items.

App-Only Shopping Benefits

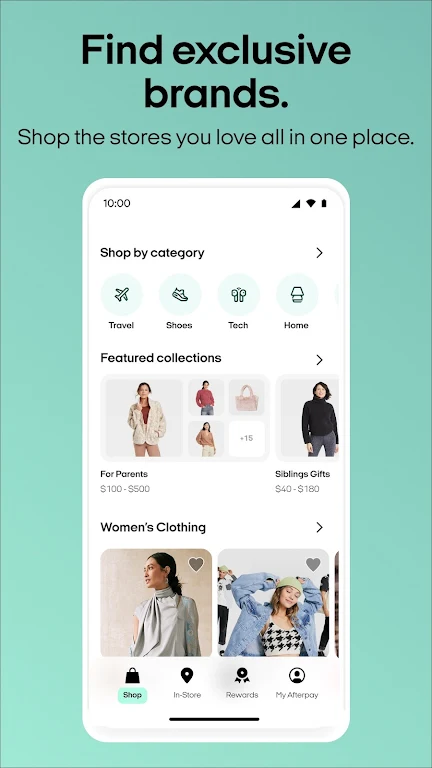

The Afterpay app offers an enhanced shopping experience with exclusive brand deals, online and in-store purchasing, and interest-free four-payment options. Browse stores, brands, products, discounts, and gift cards across various categories, including fashion, beauty, home goods, toys, technology, and more.

Flexible Payment Options

Enjoy increased flexibility with the option to pay in 6 or 12 months at participating retailers for larger purchases, simplifying financial management.

Exclusive Brands and Curated Content

Discover exclusive brands and categories, including fashion and tech, and benefit from daily curated shopping guides and inspirational content.

Effortless Order Management

Easily review past and current orders, manage payment schedules, pause payments for returns, and link your Afterpay account to Cash App for streamlined order management.

Stay Updated with Sale Alerts

Never miss a deal! Save items and receive push notifications for price drops and sales.

In-Store Convenience

Utilize your Afterpay card in your virtual wallet for seamless in-store purchases and pre-approved spending limits.

Increase Your Spending Limit

Consistent on-time payments can unlock higher spending limits, promoting responsible financial habits.

24/7 Customer Support

Access 24/7 in-app customer support via chat, FAQs, and assistance.

Terms and Conditions

Using the Afterpay app requires agreement to the Terms of Use and Privacy Policy. Eligibility requires being 18+, a U.S. resident, and meeting additional criteria. In-store use may require further verification. Late fees may apply. See the installment agreement for complete terms. California residents: Loans made or arranged pursuant to a California Finance Lenders Law license. For the Pay Monthly program, loans are underwritten and issued by First Electronic Bank, Member FDIC. A down payment may be required, APRs range from 6.99% to 35.99%, depending on eligibility and merchant. Loans are subject to credit check and approval and are not available in all states. A valid debit card, accessible credit report, and acceptance of final terms are required to apply. Estimated payment amounts shown on product pages exclude taxes and shipping charges, which are added at checkout. Complete terms are available on the Afterpay website.

Shopping

Application Description

Application Description  Apps like Afterpay - Buy Now, Pay Later

Apps like Afterpay - Buy Now, Pay Later